Blog

How do I file an exemption for an audit?

How do I file an exemption for an audit?

(1) Lodgement with SSM

(a) circulate to members within 6 months from financial year end [S258 (1)(a) of Companies Act (CA) 2016]; and

(b) submit to SSM within 30 days from circulation [S259(1)(a) of CA 2016]

(2) Prepare the unaudited account in compliance with approved accounting standard [S244 (1) of CA 2016]

(3) Lodged together with Directors’ report, Statement by Directors and Statutory Declaration [S251 and S252 of CA2016]

(4) accompanied by a certificate (refer to Appendix I) to be signed by a director.

Audit Exemption

SSM may exempt a company from appointing an auditor with criteria and conditions [Section 267(2) of CA2016].

Qualifying Criteria for Audit Exemption

Categories of private companies:

(A) Dormant companies

(B) Zero-Revenue Companies

(C) Threshold-Qualified Companies

Category A - Dormant companies

(a) has been dormant since incorporation, or

(b) dormant throughout the current and in the immediate preceding financial year.

Category B - Zero-Revenue Companies

(a) does not have any revenue during the current financial year; and

(b) does not have any revenue in the immediate past 2 financial years;

and

(c) total assets in the current and immediate past 2 financial years do not exceed RM300,000

Category C - Threshold-Qualified Companies

(a) revenue not exceeding RM100,000 in the current and immediate past 2 financial years; and

(b) total assets in the current and immediate past 2 financial years does not exceed RM300,000; and

(c) not more than 5 employees at the end of its current and immediate past 2 financial years.

Special Circumstance

The audit shall be required if receives a notice in writing from the following person not later than 1 month before the financial year-end

(a) member (holds at least 5%)

or

(b) SSM

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Bookkeeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource bookkeeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Auditor Report on Stocktake Attendance

Auditor Report on Stocktake Attendance

Question

If KTP is appointed after the FYE 31.12.2021, should we qualify the auditor report if the stock is material? if not, what should KTP do?

Opinion :

If the inventory is material to the financial statements, the auditor shall obtain sufficient appropriate audit evidence by either:-

• Attend the physical inventory counting and do the reconciliation of inventory with roll backward procedure; or

• Evaluate the management internal inventory report and perform relevant audit procedures on the report obtained to determine whether it accurately reflect actual inventory count results.

If the results are fairly stated, no qualified opinion shall be issued in the auditor’s report for inventory.

However, if the auditor is unable to perform any physical inventory counting or alternative audit procedures to obtain sufficient and appropriate audit evidence regarding the existence and condition of inventory, the auditor shall modify the opinion in the auditor’s report if the inventory is material but not pervasive.

Source:

ISA 501: https://www.mia.org.my/v2/downloads/handbook/standards/ISA/2018/06/01/ISA_501.pdf

ISA 705: https://www.mia.org.my/v2/downloads/handbook/standards/ISA/2018/08/08/ISA_705_Revised.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Maximizing Tax Benefits on Capital Expenditure

Maximizing Tax Benefits on Capital Expenditure

Company may maximize their tax benefits on the capital expenditure. Below are actions, you may take in order to help you with tax saving.

No worries, we explain to you how to maximize your tax benefits by using some real-life cases.

Capital Allowance

Generally, capital allowance is eligible for plant and machinery, or tools and equipment for business.

What are tools and equipment?

Some examples of the case law to enhance our understanding.

KPHDN v Tropiland Sdn Bhd (2012) (Court of Appeal)

• The argument here is whether the 7-storey car park is a tool and equipment to the business?

• The taxpayer is a property developer and constructed a multi-story car park before letting it out. They claim a capital allowance for the car park.

• The taxpayer’s income was derived from the rental of the car park. Without the multi-story car park, the taxpayer could not have generated an income from the land.

Hence, they can claim the capital allowance for the car park.

Industrial Building Allowance(IBA)

If you own or rent a factory for your business, you may claim the qualifying expenditures under Industrial Building Allowance (IBA).

Reinvestment Allowance(RA)

The definition given by MIDA, RA is available for existing companies engaged in manufacturing and selected agricultural activities that reinvest for expansion, automation, modernization, or diversification into any related products within the same industry on condition.

Lavender Confectionery & Bakery Sdn Bhd V KPHDN

Lavender is a manufacturer, distributor and dealer in cakes, confectionery, bread and biscuits.

In YA 2011, the company claimed Industrial Building Allowance (IBA) for the additional demolition of substructures and renovation and Reinvestment Allowance (RA) for plant and machinery for JB factory and KL Outlet.

However, it had been rejected due to one of the demolition cost before constructing the buildings which did not form part of the Lavender’s factory. Company is also disallowed to claim under RA due to the items are not used in the factory.

For IBA claim of the Company, the decision of the Court is the Company can claim for the IBA since they fulfilled the IBA claim requirement of building used for purpose of business and used as a factory.

The Company can claim for RA as they fulfilled the RA claim requirement as

• The Company must be a resident of Malaysia

• An operation for more than 36 months

• Incurred capital expenditures are for the expansion of their business.

As their outlet in KL continues the manufacturing process of bread and confectionaries in the principal factory at Plentong.

The capital expenditures incurred for plant and machinery that leads to the expansion of Company’ business is entitled to RA.

What does KTP say?

From the story above, we can understand that the determining factor between Capital allowance and Industrial building allowance is whether it is a “tool” to generate income or it is a ''building'' that is used as industrial business purposes.

Qualified expenditure can be the assets themselves and also the incidental cost incurred on the assets. To maximize your claim, we can always go back to the ruling or act to look at the definition.

Sources

KPHDN v Tropiland Sdn Bhd (2012) (Court of Appeal)

https://bit.ly/3MIlDBq

Lavender Confectionery & Bakery Sdn Bhd V KPHDN

https://bit.ly/35RDSnn

Qualifying Expenditure and Computation of Industrial Building Allowances

https://bit.ly/379lK8P

Qualifying Expenditure And Computation Of Capital Allowances

https://bit.ly/366wQek

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

earning stripping rules malaysia lhdn

Update on Earning Stripping Rule (ESR)

The Income Tax (Restriction on Deductibility of Interest) (Amendment) Rules 2022 (“Amendment Rules”) has been gazetted to amend the Income Tax (Restriction on Deductibility of Interest) Rules 2019.

The following two Principal Rules is amended in amendment rules:

1. Definition of qualifying deduction

2. Carrying forward of excess interest

The amendment rules came into operation on 1 February 2022.

Key takeaways:

You will understand: -

1. What is ESR?

2. Scope of application

3. New amendment on Principal Rules

4. Non-application

Summary of learnings:

1. What is ESR?

Effective from 01 July 2019, ESR was introduced under Section 140C of the Income Tax Act 1967 (ITA) to restrict the tax deduction on interest expenses in relation to financial assistance in a controlled transaction.

Under the ESR, the maximum amount of interest that can be deducted is 20% of the tax – EBITDA (earnings before interest, tax, depreciation, and amortization).

*Tax – EBITDA = Adjusted Business Income + Qualifying deduction+ Total Interest Expenses claimed in business Income.

2. Scope of application

ESR apply to interest expenses that arise from financial assistance granted by:

- its associated person outside Malaysia;

- its associated person outside Malaysia which operates through a permanent establishment in Malaysia;

- a third party outside Malaysia where the financial assistance is guaranteed by its holding company or any other enterprises under the same MNE Group

Financial assistance includes loans, interest-bearing trade credit, advance, debt, or the provision of security or guarantee.

3. New amendment on Principal Rules

The amendments are as outlined below:

i. Definition of qualifying deduction

Qualifying deduction is equal to the total incentive claims (special deduction, further deduction, double deduction, etc.) deducted in arriving at adjusted income. The definition is replaced as follows:

- where there is business expenditure incurred in the profit and loss account is allowed as deduction under the Act and the amount of the deduction allowed exceeds the amount of the business expenditure incurred, an amount equal to the difference between the amount of the deduction allowed and the amount of the business expenditure incurred in the profit and loss account; or

- where there is no business expenditure incurred in the profit and loss account, the amount of deduction is allowable under the Act.

ii. Carry forward rules

- The carry forward rules allow the restricted interest expenses in a year of assessment (YA) to be carried forward and to be deducted against the company’s adjusted income for the subsequent YAs.

- This rule now applies to any person and is not limited to a company.

4. Non-application

According to the De minimis threshold, ESR is not applicable where the total interest expenses for all financial assistance is equal to or less than RM500,000 in a YA.

Source:

Income Tax (Restriction on Deductibility of Interest) (Amendment) Rules 2022:

https://phl.hasil.gov.my/pdf/pdfam/ESR_Rules_Pindaan_2022.pdf

Restriction on the deductibility of interest guidelines:

http://lampiran1.hasil.gov.my/pdf/pdfam/RDIG_05072019.pdf

This message was brought to you by KTP

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Form E 常见错误

Form E 常见错误

回顾我们过去在 2021 年 16 月 3 日为 KTP|THK 客户举办的免费网络研讨会,由 Ms Caroline Lim 主持 as speaker.

https://youtu.be/84szaL-0Tok

阅读我们过去在 Form E 上的社交媒体帖子

Part 2 Form EA - Benefit in kind and perquisites

1) 董事医疗费 是 免税 (tax free) ??? 实物受益(benefit in Kind) ??? dated 19/02/2021

2) 1分钟学习“如何在BIK / Perquisites计算PCB” dated on 17/02/2021

3) 只要你点进来,你能看到员工薪酬-税务节省大秘密 BIK 章 Part I dated 10/02/2021

4) 只要你点进来,你能看到员工薪酬-税务节省大秘密 Part II dated 08/02/2021

5) 注意!你是否有正确的计算与提交预扣税(PCB)。dated on 26/01/2021

This message was brought to you by KTP

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Book-keeping, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource book-keeping, and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

E呈报(E Filing)Form E

E呈报(E Filing)Form E

Read our full story in our bloghttps://www.ktp.com.my/blog/efiling-forme-2021/08mar2022

阅读我们过去在 Facebook 上的 E/EA 表格上的分享 :

1) Tax Filing Deadline 2022 Malaysia dated on 10/01/2022

2) E呈报(E Filing)Form E 终极秘籍 dated on 15/03/2021

3) 温馨提示 - Form E 截至日期为31/03/2021 dated on 12/03/2021

4) Form EA 有什么? Dated on 22/02/2021

5) 花红几时需要报进Form EA? Dated on 16/02/2021

6) 公司给员工红包可不可以扣税? Dated on 10/02/2021

7) Deadline for Form E submission is approaching! dated on 09/02/2021

8) 是时候呈报𝐅𝐨𝐫𝐦 𝐄了,让我们为您复习一遍!dated on 28/01/2021 各位雇主与员工请注意!!!

9) 你知不知道 ... IRB不再打印+发E表格(Form E) 给雇主! Dated on 25/01/2021

Reinvestment Allowance LHDN

Common mistakes in claiming reinvestment allowance

Reinvestment Allowance is a red flag to IRBM so Reinvestment Allowance is always scrutinized by our IRBM during tax audit/investigation.

What is reinvestment allowance?

Reinvestment allowance (RA), as the name suggests, is an incentive to encourage companies to reinvest and expand their businesses. It is only granted after the company has been in business for a certain period of time, and only to companies resident in Malaysia.

How good is reinvestment allowance?

The allowance is given for 15 years from the first year of claim. The allowance is computed at 60% of QCE incurred and can be utilised against 70% of statutory income

Latest development in reinvestment allowance

Budget 2021 has announced that a special Reinvestment Allowance (RA) will be given for eligible manufacturing and agricultural projects in Years of assessment (YA) 2020 to YA 2022.

This means that eligible companies that have fully utilized their 15-years RA can enjoy additional RA claims for 3 years (YA2020 to YA2022).

Common mistakes in claiming reinvestment allowance

-

The purchase invoice is the only supporting document available. The absence of a project paper, feasibility study, business plans, budgets, directors resolutions, and other relevant documents supporting the project;

-

Mismatch between the company incurring the investments and the company using the plant and machinery;

-

Claim RA on assets incurred for the benefits of related companies/directors.

-

Claim RA on non-qualifying activities.

-

Claim RA on the transfer of assets from related parties who have previously claimed RA on the same assets.

-

The absence of payment records to support the qualified assets.

-

Supporting documents are not kept for at least 7 years.

-

Clain RA concurrently with other tax incentives (like PS, ITA & etc).

-

No written/ pictorial production flow on the qualifying project

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Investment in Associates MPERS

Investment in Associates MPERS

Commonly asked question on investment in associates :

* How do you account for investment in associates?

* Is investment in associates a current asset?

* How do you record investment in accounting?

What is an investment in associates?

An investor has a significant influence on the investee’s decision of its

- Financial policy; and

- Operating policy

What is a significant influence?

- Power to participate in the financial and operating decisions of the investee

- Investor holds directly or indirectly ≥ 20% voting power of the investee

- For shareholdings < 20%, the significant influence must be clearly demonstrated to classify the investment as associate

What is the document showing the significant influence of an investor?

- Representation on the board of directors

- Participation in the investee’s policy-making processes, including participation in decisions about dividends or other distributions

- Material transactions between the investor and the investee

- Interchange of managerial personnel

- Provision of essential technical information

Recognition and measurement of investment of associates

(i) Cost model

- Cost less accumulated impairment losses.

- Recognise dividends and other distributions received from the investment as income.

(ii) Equity method

- Recognised at the transaction price (include transaction costs)

- Share of post-acquisition profits or losses

- Dividends received from an associate merely reduce the carrying amount of the investment.

(iii) Fair Value model

- Measured at the transaction price (exclude transaction cost)

How to Present

- classify investments in associates as non-current assets

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Form E 2021 LHDN

Top 7 questions on Form E 2021

Overview

From 01 March 2022, the employer must submit Form E for the Year 2021 and the submission can be done through LHDNM electronic filing system.

Let's mark the date so that we will not miss the deadline.

Key takeaways:

You will understand the responsibility and consequences as follows: --

1. What is Form E?

2. Who is the employer?

3. Who is compulsory to furnish Form E?

4. Who is exempted for the C.P.8D?

5. What is the information to be included in Form E?

6. What is the deadline for Form E & EA?

7. What is the consequence fail to submit Form E?

Summary of learning

1. What is Form E?

- Form E is a declaration report to be submitted by every employer to LHDNM every year not later than 31 March.

2. Who is the employer?

- The employer has included Company, Limited Liability Partnership, Partnership, Enterprise and etc.

3. Who is compulsory to furnish Form E?

- All employer (active and dormant companies) whether it has an employee or do not have any employees.

4. Who is exempted for submitted C.P.8D?

- Sole proprietorship, partnership, Hindu joint family and deceased person’s estate who do not have employees are exempted for the submission.

5. What is the information to be included in Form E?

There are 4 parts in Form E.

(a) Basic information

- Name of the employer as registered under SSM

- Employer’s E number

- Status of the employer

- correspondence with LHDNM and etc

(b) Information on a number of employees for the year ended 31 December 2021

- Number of employees as of 31/12/2021 included for those subject to Monthly Tax Deduction, new employees or ceased employment or died.

- Employees include full time/part-time/contract employees and interns.

(c) Declaration

- Declared by the employer.

(d) C.P.8D Return of Remuneration from the Employment, claim for deduction, and particulars of tax deduction under the Income Tax Rules (Deduction from Remuneration) 1994 for the Year Ended 31 December 2021

- Employers are required to complete all particulars of employees in C.P.8D.

6. What is the deadline for Form E & EA?

- Form EA: provide to employees not later than 28 February 2022

- Form E: submit to LHDNM not later than 31 March 2022

7. What is the consequence fail to submit Form E?

- The employer is liable to a fine of RM200 - RM20,000 or imprisonment for a term not exceeding six months of both.

Sources

Return Form of Employer (Remuneration for the Year 2021)

https://phl.hasil.gov.my/pdf/pdfam/ExplanatoryNotes_E2021_2.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Special Tax Deduction Flexible Working Arrangement

Special Tax Deduction Flexible Working Arrangement

The Flexible Work Arrangement (FWA) Income Tax Deduction is an initiative by our Malaysian government to support eligible employers who implement or enhance FWA for their company.

Scope of Expenses on Tax Incentive on FWA

A double deduction is given for the following expenses:

(a) Consultation fees

(b) Cost of capacity development

(a) Training courses or programme fees

(b) Internal trainer fees

(c) Cost of training materials

(d) Rental of training space

(e) Examination fees, and

(f) Training-related travelling expenses incurred by the trainers and employees as follows:

i. Transportation:

a. Travels from Malaysia to outside Malaysia, and vice versa

- Amount equal to economic class air fare

b. Travels within Malaysia

- Air transport: Amount equal to economic class air fare

- Land or water transfer: Actual cost

ii. Accommodation: Capped at RM300 per day

iii. Meals: Capped at RM150 per day

(c) Cost of software

(d) Software subscriptions

Tax Incentives on FWA

The deduction is given for a period of three consecutive YAs, commencing from the YA in which the certification of the implementation of FWA is given by TalentCorp.

The Income Tax (Deduction for the Cost of Implementation of Flexible Work Arrangements) Rules 2021 [P.U.(A) 377] were gazetted on 4 October 2021.

The Rules are deemed to be effective from YA 2020.

Qualified Company

A Malaysian-resident, which is a:

(a) Company incorporated under the Companies Act 2016

(b) Limited liability partnership registered under the Limited Liability Partnerships Act 2012, or

(c) Partnership registered under the Partnership Act 1961

How to apply?

1. Read the Guidelines and FAQ for the eligibility and criteria.

2. Fill in the Application Form and the Declaration Form

3. Submit the application via email flexworklife@talentcorp.com.my

4. Successful application will receive the Surat Pengesahan Pengaturan Kerja Flekisble, for your e-filing with LHDN.

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Can LHDN access your bank account?

Under what circumstance your bank information is accessible by LHDN?

The new provision does not give it absolute power to simply access taxpayers' bank account information.

It is only limited to cases involving garnishee orders allowed by the Court.

LHDN is required to go through a prescribed process of judgment and is only limited to cases that have already gone through a civil proceeding before.

What is garnishee order?

The garnishee proceedings are the process of enforcing a monetary judgment by seizing or withholding debts due to a specific party.

LHDN has the right to do so because of the existence of unpaid tax arrears by the taxpayer.

Source:

https://phl.hasil.gov.my/pdf/pdfam/KM_HASiL_18122021_HAD_AKSES_AKAUN_BANK.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

What is ESG Malaysia

什么是ESG报告认证?

所谓ESG报告的认证,也就是聘请独立第三方对企业CSR报告/ESG报告/可持续发展报告进行审核,给出一个客观的结论,以表明这份CSR报告是不是做到客观、是不是披露了实质性(重大性)议题、是否完整等。

市场上通常是四大会计师事务所(瑞士通标SGS、英国标准协会BSI、普华、安永、毕马威、德勤)和传统的质量认证机构(挪威船级社、法国必维、德国莱茵、英国劳氏等)为企业提供这方面的服务,遵循的标准一般是AccountAbility发布的AA1000AS标准,也有的会同时应用国际鉴证业务准则ISAE3000(修订版),或者自成一体糅合上述准则成为自已的一套标准,但原理基本上一样的。

报告认证,对应的英文是Report insurance,也有人将之翻译为审验或验证,因为对传统的质量认证机构来说,认证是verification/audit之类的服务,这个Report insurance不太一样。

而在会计师事务所,为了话术上的一致,会翻译成鉴证。术语不同,意义是一致的。

Deduction for Expenditure on Provision of Employees’ Accommodation

Deduction for Expenditure on Provision of Employees’ Accommodation

Overview:

Are you planning to let your employees back to the workplace but are too afraid of the number of COVID cases reported every day? You may consider Safe@Work introduced by the Ministry of International Trade and Industry (MITI). This allows business continuity even when there are positive cases in the work place.

On 24 December 2021, the Government announce a further tax deduction on rental expenses provided for employees to promote Safe@Work program.

Key takeaways:

1) Who can apply?

2) How to apply?

Summary of learnings:

The company is allowed to deduct an amount equivalent to the expenses incurred on rental of a premise for the purpose of employees’ accommodation within the period from 1 January 2021 until 31 December 2022, subject to a maximum amount of RM50,000 for each company. The company must obtain Certificate from Ministry of International Trade and Industry to enjoy this deduction.

1. Who can apply

A company which: -

- Incorporated under Company Act 2016;

- carrying on the business of manufacturing or manufacturing related services; and

- Incurred rental for the purpose of employees’ accommodation.

2. How to apply?

Step 1 : To comply with Safe@Work SOPs

Step 2 : To comply with the Minimum standards of accommodation set by MoHR

Step 3 : Obtain the certificate in CIMS system

Sources & Relevant Links:

• P.U. (A) 470 – Deduction for expenditure on provision of employees’ accommodation

https://lom.agc.gov.my/ilims/upload/portal/akta/outputp/1718705/PUA%20470.pdf

• Information Related to Safe@Work:

https://www.miti.gov.my/redir/safeatwork/safeatwork.html

• Minimum standards of accommodation

https://jtksm.mohr.gov.my/images/akta446/1_panduan_pemohon_v2.pdf

• Registration or login to CIMS

https://notification.miti.gov.my/login

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

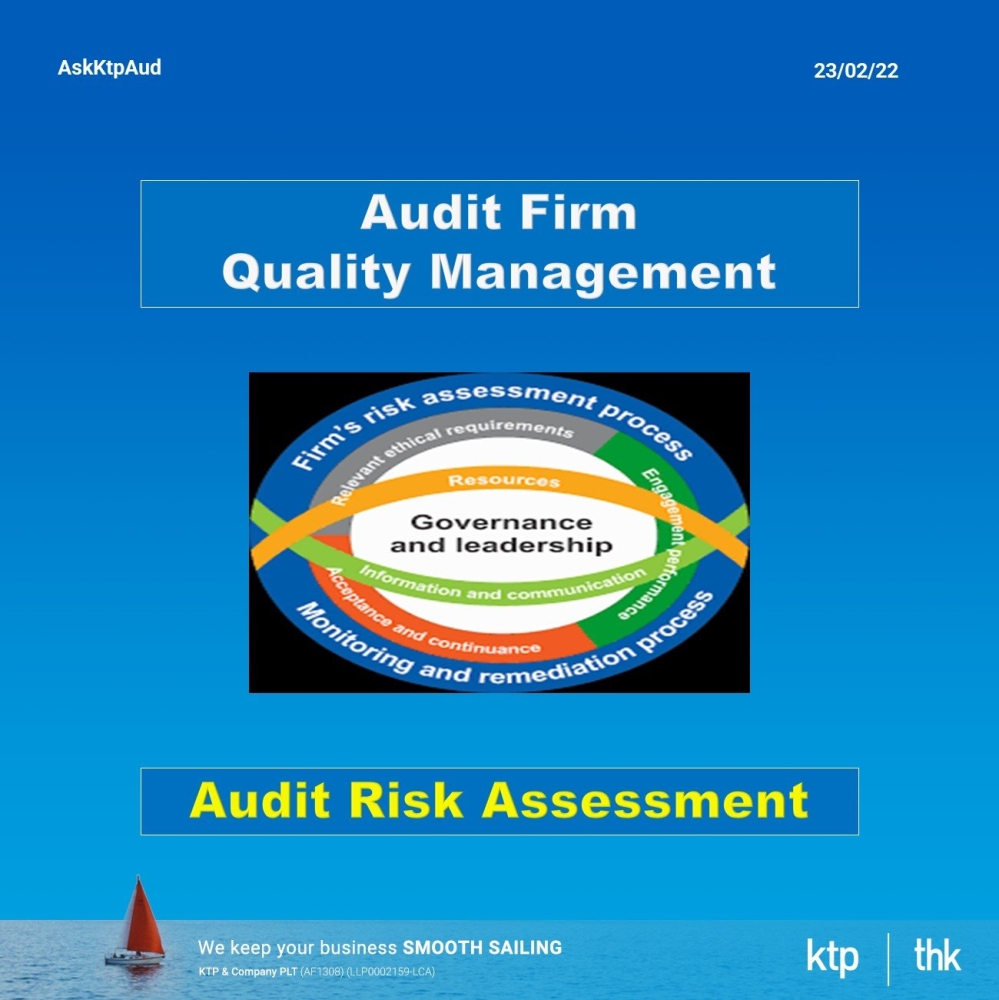

ISQM 1 Audit Risk Assessment

ISQM 1 Audit Risk Assessment

The foundation of ISQM 1, and a key change from extant ISQC 1, is that the firm needs to follow a risk-based approach to quality management, which focuses the firm on :

The firm’s risk assessment process is new to ISQM 1.

• The risks that may arise, given the nature and circumstances of the firm and the engagements it performs; and

• Implementing responses to appropriately address those risks.

A risk-based approach helps the firm tailor the SOQM to the firm’s circumstances, as well as the circumstances of the engagements performed by the firm. It also helps the firm effectively manage quality through concentrating on what matters most given the nature and circumstances of the firm and the engagements it performs.

ISQM 1 requires the firm to have a risk assessment process, the purpose of which is to establish quality objectives, identify and assess quality risks and design and implement responses to address the quality risks.

3 main steps

In designing the quality management system, there are three main steps :

(i) Establish quality objectives to achieve the objective of the system of quality management;

(ii) Identify and assess quality risks to provide a basis for the design and implementation of responses;

(iii) Design and implement responses to achieve those quality objectives.

Quality objectives

The quality objectives are outcome-based to manage quality through the identification of risks. These objectives are established to address possible quality risks that may result in non-quality engagements. For example, insufficient work performed for planning may result in inappropriate identification of audit risks and other significant audit issues.

ISQM 1 specifies quality objectives that firms need to establish, and these objectives are mandatory to be adopted by firms, where applicable. For example, the quality objective of assigning roles and responsibilities for the system of quality management within the firm may not be relevant for a sole practitioner.

In addition to those prescribed by ISQM 1, firms will also need to consider if additional quality objectives are required to be established based on the firms’ risk assessment processes, where applicable.

Quality Risk

One of the new requirements of ISQM 1 is the identification of quality risks with respect to the nature and circumstances of the firms and their engagements. For example, the complexity and operating characteristics of the firm, management style of leadership, client portfolio and complexity of the engagements performed by the firm will impact the risk assessment process and result in different quality management systems for individual firms.

There are no prescribed quality risks in the standards. Firms are required to obtain an understanding of the conditions, events, circumstances, actions or inactions that may adversely affect the achievement of the quality objectives with respect to the nature and circumstances of the firms and their engagements prescribed in paragraph 25(a) of ISQM 1, with the caveat that the list is non-exhaustive.

Firms are expected to identify their own quality risks, assess if a risk has a reasonable possibility of occurring, and how the risk may adversely affect the achievement of one or more quality objectives when it occurs, either individually or in combination with other risks.

Responses

Once the quality objectives and their quality risks have been established (other than some responses specified in the standard that firms are required to design and implement), firms are expected to develop their own responses to address the identified quality risks.

It is also important to take note of the interconnectivity of different components, such as, ethics-related requirements are being dealt with in the information and communication component, as well as the relevant ethical requirements component.

The responses to common quality risks identified by different firms may differ as each firm is faced with varying conditions, events, circumstances, actions or inactions.

Hence, firms will need to customise the design, implementation and operation of their quality management systems to ensure that they are responsive to changes in the nature and circumstances of the firms and their engagements.

The next few sections will illustrate the key principles of the remaining components with an example of quality risk and the proposed corresponding response.

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

tax rebate 20,000 malaysia

Tax rebate for new incorporated company LHDN

Income Tax (Conditions for the Grant of Rebate under Subsection 6D(4) Order 2021 @ 31/12/21

This order has effect from the year of assessment 2021.

Conditions for the grant of rebate

-

Own by the company with paid-up share capital not more than RM2.5 million.

-

Different premises from its related company.

-

Shall not use the plant, equipment & facility of the related company.

-

Employee (except CEO & director) is different from related company.

-

Business is different from related company.

-

Business is different from sole proprietorship.

-

Not M&A with paid up share capital more than RM2.5m or revenue RM50m.

Other pertaining key information

Related company refer as more than 50% of paid up share capital.

A rebate may be granted for YA 2021 and 2022 on company commence business operation after 1/7/2020 with basis period ended 31/12/2020.

Source :

PU Order 504_2021 Income Tax (Conditions for the grant of rebate under subsection 6D(4) order 2021 on 31.12.2021.

https://lom.agc.gov.my/.../outputp/1719408/PUA504_2021.pdf

Update on our past blog on tax rebate

a. 有限公司或有限合伙企业的回扣 (RM20,000 x 3 years) – Post on 19.11.2020

https://www.ktp.com.my/blog/ns9lfg2j36acs7w-bphe6-pbtm3-k6mng-gzk5f-taxrebateenglish-bg3t3

b. 𝐓𝐚𝐱 𝐑𝐞𝐛𝐚𝐭𝐞 (𝐑𝐌𝟐𝟎,𝟎𝟎𝟎 𝐱 𝟑 𝐲𝐞𝐚𝐫𝐬) 𝐨𝐧 𝐟𝐨𝐫 𝐜𝐨𝐦𝐩𝐚𝐧𝐲 𝐨𝐫 𝐥𝐢𝐦𝐢𝐭𝐞𝐝 𝐥𝐢𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐩𝐚𝐫𝐭𝐧𝐞𝐫𝐬𝐡𝐢𝐩. – Post on 19.11.2020

https://www.ktp.com.my/blog/ns9lfg2j36acs7w-bphe6-pbtm3-k6mng-gzk5f-taxrebateenglish

c. The advantages of buying property via Sdn Bhd? Posting on 16 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd/16april2021

d. The disadvantages of buying property via Sdn Bhd (Copy) Part 2 Posting on 19 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd-part2/19april2021

e. Investment holding company enjoy tax rebate RM20,000 x 3 years ? Part 3 Posting on 20 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd-part3/20april2021-hgpza

f. Can unlisted investment holding company (IHC) enjoy tax rebate RM20,000 x 3 years? Part 4 Posting on 21 April 2021

https://www.ktp.com.my/blog/buy-property-via-sdn-bhd-part4/21april2021

g. 预算案 2022 Posting on 19 November 2021

https://www.ktp.com.my/blog/tax-budget-2022-sme-edition-chinese/19nov21?rq=20%2C000

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Medical Fee on Director -Tax exempted Benefit In Kind?

Medical Fee on Director -Tax exempted Benefit In Kind?

FAQ from our clients on this common mistake by taxpayers based on our past experience :

-

Why are company’s directors not human meh?

-

Why is my ex ''tax agent'' allow?

-

Why is the Malaysian government like this?

Tax standing

Under section 13(1) b Income Tax 1967, medical and dental benefits are exempted from income tax for the employee.

Exception

Does the exemption extend to directors of a controlled company like for any other employees of the company?

Under paragraph 8.3.1 of IRB Public Ruling No. 11/2019- Benefits In Kinds., if the employee receiving BIK from the employer has control over his employer (company) is no exemption.

What is control?

For a company, the power of an employee to control is through :

1. The holding of shares or

2. The possession of voting power in or

3. By virtue of powers conferred by the articles of association or other document.

For a partnership, the employee is a partner of the employer.

For a sole proprietor, the employee and the employer is the same person

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

What costs are included in fixed assets?

What costs are included in fixed assets?

When acquiring a factory, except for the cost of land and building, we have to incur many other costs, such as:-

i) dismantling the items left by the previous owner,

ii) renovation cost,

iii) legal fees for the loan agreement, and

iv) Other administration costs.

Can we capitalize all of the cost as “assets”?

Dismantling and renovation costs as i & ii above, can be capitalised,

Legal fees and other administrative costs as iii & iv above need to be expense off.

Generally, we should capitalize all of the costs as long as there are incurred directly attributable to bringing the asset to the condition necessary for it to be capable of operating in the manner intended by management.

Expensed off cost

However, there are some costs specifically mentioned in the standards which we should NOT capitalized:

- Cost of opening a new facility

- Cost of advertising and promotional activities

- Cost of staff training

- Administration and other general overhead costs

- Borrowing costs

Source

Section 17 Property, plant and equipment -

https://www.cas.net.my/wp-content/uploads/2013/02/MPERS-Framework.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Are gifts to employees considered income?

Is gift from employer taxable?

When I received a gift or reward from my employer during the New Year celebration, will this affect my tax payable?

Overview

In a competitive business climate, a gift or reward has been proven to improve organizational values, enhance team efforts, increase customer satisfaction and motivate certain behaviours amongst members of staff.

However, do you know the tax impact of the gift or reward received?

Key takeaway

You will understand the:

-

Meaning of perquisites

-

Tax treatment of perquisites

What are Perquisites?

Perquisites are benefits in cash or in-kind which are convertible into money received by an employee from his/her employer or from third parties in respect of having or exercising employment.

Perquisite is a chargeable income to tax as part of the gross income from employment under paragraph 13(1)(a) of the ITA.

Tax treatment

1. In respect of having employment or exercising an employment

a) Gift

The value of the gift is chargeable to tax when it is received, can be sold, assigned, or convertible into cash, and is received in appreciation for the performance of past services.

However, there is an exemption of RM2,000 under paragraph 25C, Schedule 6 of the ITA if is for a long service award.

b) A sum of cash

Cash money is considered a perquisite if it is an appreciation for the excellent service rendered even though it is given voluntarily by the employer.

* The phrase having employment or exercising employment includes the performance or any duties by an employee.

2. Not related to having or exercising the employment

Pure gifts or testimonials received by an employee from his employer or third parties purely for personal appreciation or for specific personal reasons are not taxable.

Examples of pure gifts or testimonials include:

a) wedding gifts whether, in the form of cash, jewellery or other items were given to an employee by the employer.

b) cash is given to an employee by the employer for passing the professional examination with excellent results.

c) cash, other items and certificate of appreciation given to an employee for his/her extraordinary achievement.

Source:

Public Ruling 5/2019 Perquisites from Employment

http://lampiran1.hasil.gov.my/pdf/pdfam/PR_05_2019.pdf

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

What is tax exempted allowance in Malaysia?

Which allowances and perquisites are totally exempted?

Common tax questions from clients :

1. What income is not taxable in Malaysia?

2. Any tax exempted benefits in kind to employees in Malaysia?

3. Which allowances and perquisites are totally exempted?

Employment Income

Statutory income from employment refers to not only your monthly salary, but also any commission, bonus, allowances, perquisites, benefits-in-kind, and even accommodation.

Exempted Employment Income

Of course, there are certain types of income within this list that does not have to be included in your income for tax purposes – in other words, income that is exempted from tax. If you are given a tax exemption up to a certain value, you don’t have to include that amount in your declaration of income.

Exempted Benefit-in-kind / perquisite

Petrol, travel, toll allowances

Up to RM6,000. If the amount exceeds RM6,000, further deductions can be made in respect of the amount spent for official duties.

Parking allowance, including parking rate paid by the employer directly

Actual amount expended

Meal allowance received on a regular basis

Actual amount expended

Medical benefits (including traditional medicine and maternity expenses) Actual amount expended

Child care allowance for children up to 12 years old

Up to RM2,400.

Benefit, whether in money or otherwise, for past achievements, service excellence, or long service award, etc

Up to RM2,000.

Gift of fixed-line telephone, mobile phone, etc registered in employee’s name

Limited to 1 unit for each asset

Monthly bills for phone or broadband line registered in employee’s name Limited to 1 line for each category of asset

Company goods provided free or at a discount to the employee, spouse, or unmarried children

Up to RM1,000

Subsidised interest for housing, education, or car loan

Fully exempted if total loan amount does not exceed RM300,000. For exceeding amounts, there is a calculation formula that you can find in the explanatory notes to the BE form.

Leave passage (vacation time paid for by employer)

Exempted up to 3x in a year for leave passage within Malaysia (fares, meals, accommodation) and 1x outside Malaysia (up to RM3,000 for fares only)

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks

Difference between the contract of service and contract for service

Difference between the contract of service and contract for service

FAQ from our CLIENTS :

1. Is EPF compulsory for all employees even though employees agree on the EPF non-deduction?

2. What happens when EMPLOYERS refuse for EPF/Sosco/EIS/PCB/HRDF?

3. What happens when EMPLOYEES refuse for EPF/Sosco/EIS/PCB/HRDF?

We shall explain the important differences between Contract of Service and Contract for Service.

Contract of Service

-

A contract of service is also known as an employment contract. Meanwhile, the roles in the contract agreement are like “Employer & Employee”.

-

The contract agreement can be oral, written, express, or implied.

-

Terms of termination under employment act 1955.

Contract for Service

-

A contract for service can be known as a contract between an independent contractor or sub-contractor providing services to the client. The services could be an assignment or project.

-

The contract agreement is usually in writing.

-

Follow the terms & conditions stated in the agreement.

What are the statutory benefits - Contract of Service

-

Wage period will be one month and the payment of wages cannot be later than the seventh day after the last day of the wage period.

-

The wages must include lawful deductions such as EPF, SOCSO, EIS and PCB.

-

Working hours will be 8 hours a day and total more than 48 hours a week.

-

General paid annual leave, paid sick leave and holiday.

-

Termination, lay-off and retirement benefits.

-

Maternity protection

What is the statutory benefit - Contract for Service

No statutory benefit for independent contractors and sub-contractors. Only follow the terms and conditions stated in the contract agreement.

Example - Contract of Service

ABC Sdn Bhd is a manufacturing company. They hire an internal worker to do the daily cleaning job in the factory. The company and worker have signed an employment contract. This worker also can enjoy the EPF, SOCSO, EIS, and paid leave which are provided by ABC Sdn Bhd. This kind of relationship between employer and employee will be a contract of service.

Example - Contract for Service

ABC Sdn Bhd is a manufacturing company. They engaged a sub-contractor to provide cleaning services for the factory once a week. ABC Sdn Bhd only paid the cleaning fee and without EPF, SOCSO & EIS to the sub-contractor which was agreed and stated in the signed contract. This kind of relationship between contractor and client will be a contract for service.

Summary Contract of Service

-

Has employer-employee relationship

-

The employee does business for the employer

-

Covered by the Employment Act

-

Includes terms of employment such as working hours, leave benefits, etc.

Summary Contract for Service

-

Has client-contractor type of relationship

-

The contractor does business for their own account

-

Not covered by the Employment Act

-

Statutory benefits do not apply

Visit Us

-

Wisma KTP, 53 Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

-

Wisma THK, 41, Jalan Molek 1/8, Taman Molek, 81100 Johor Bahru

KTP (Audit, Tax, Advisory)

An approved audit firm and licensed tax firm operating under the KTP group based in Johor Bahru providing audit, tax planning, advisory and compliance services to clients

-

Website www.ktp.com.my

-

Instagram https://bit.ly/3jZuZuI

-

Linkedin https://bit.ly/3sapf4l

-

Telegram http://bit.ly/3ptmlpn

THK (Secretarial, Account, Payroll, Advisory)

A licensed secretarial firm in Johor Bahru providing fast reliable incorporation, secretarial services, corporate compliance services, outsource booking, accounting and payroll services to clients

-

Website www.thks.com.my

-

Facebook https://bit.ly/3nQ98rs

KTP Lifestyle

An internal community for our colleagues on work and leisure.

-

Tiktok http://bit.ly/3u9LR6Q

-

Youtube http://bit.ly/3ppmjyE

-

Facebook http://bit.ly/3ateoMz

-

Instagram https://bit.ly/3jZpKLo

KTP Career

An external job community on vacancy in Johor Bahru for interns, graduates & experienced candidates.

-

Instagram https://bit.ly/3u2PxHg

-

Facebook http://bit.ly/3rPxz9o

#Ktp #Thks